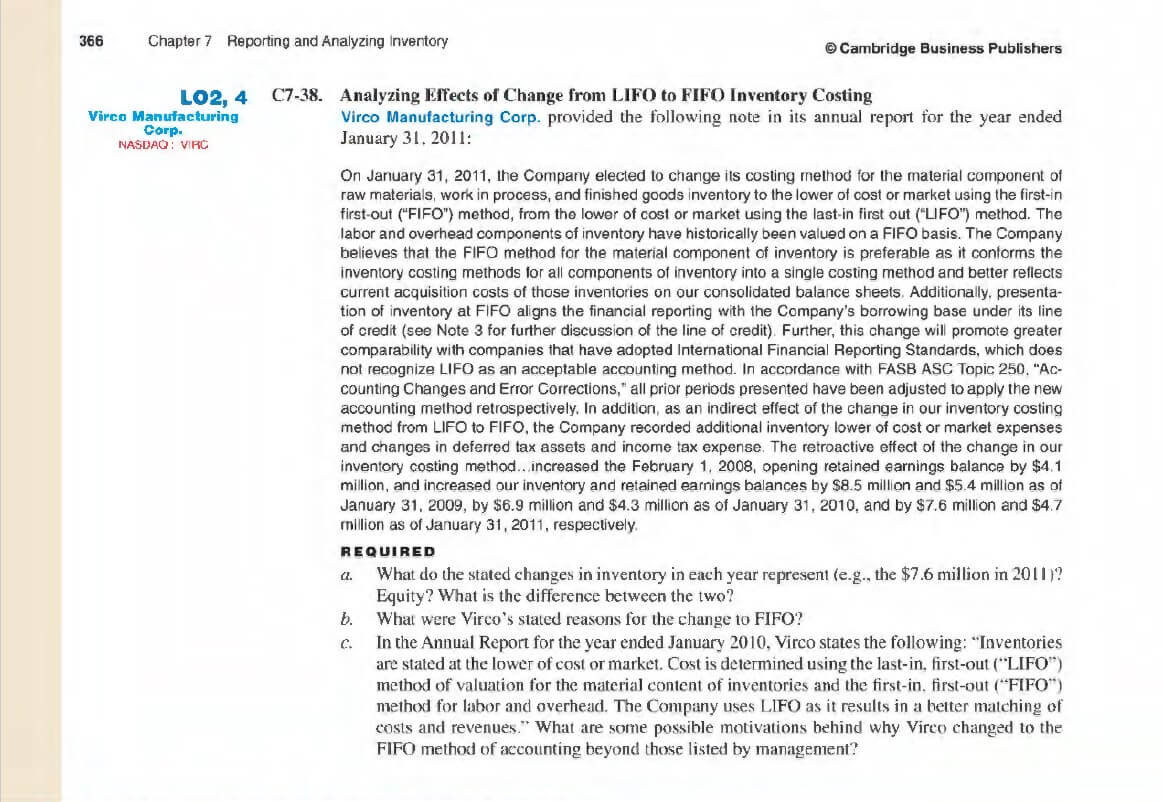

Analyzing the effects of change from LIFO to FIFO Inventory Costing

Please read case C7-38 on page 366 and prepare a 1-2-page case analysis. Within your case analysis, please be sure that you are identifying the major issue(s); determining the scope of the problem; and analyzing the issue(s) and the outcome(s) and provide recommendations. It is recommended that you incorporate course material and additional readings (i.e., journal articles, books, etc.) into your analysis to strengthen the content of your paper. Within your analysis, please be sure to incorporate the answers to the questions at the end of the case study into your paper.

It is a good idea to organize your paper in at least 4 sections:

1.) Summary of the case (i.e., stakeholders; key players; background).

2.) Identify the scope of the problem.

3.) Analyze the issue/outcome.

4.) Recommendations.

Please submit your paper in a Word file in APA format with a cover and reference page.

Please make sure that your references are in APA format.

Answer

Analyzing the effects of change from LIFO to FIFO Inventory Costing

By: Essayicons.com

Summary of the case (i.e., stakeholders; key players; background).

The Vicro manufacturing company chose to use the first-in-first-out (FIFO) technique for every element of natural resources, work in progress, and finished goods inventories, rather than the last-in-first-out (LIFO) method, to determine the lowest cost (LIFO). The company understands that the FIFO technique is preferred for physical inventory parts since it aligns inventory accounting techniques for all stock constituents. The income statement of inventories is aligned with the firm’s lending base underneath its credit line when it is presented as FIFO. Furthermore, the company registered higher stocks lower of price or market expenditures and adjustments in deferred taxes and earnings tax bill, as an indirect result of the shift in our inventories valuation method from LIFO to FIFO.

Identify the scope of the problem.

The FIFO approach makes it appear as the organization has more income than it does because costs have been steadily rising for years. Thus, the downsides of FIFO include how it creates the impression like a corporation is earning a larger revenue than they are, at least at the moment. If FIFO is employed in times of inflation, this relatively large profit will, of course, result in higher taxation. Increased taxes as a result of FIFO value reduce the company’s financial performance and potential growth.

Since LIFO might lead to earlier stock never being moved or marketed, it is more difficult to sustain than FIFO. Since the prices of unsold products don’t exit the accounting system, LIFO creates more complicated documentation and financial reporting. LIFO has not suggested if a company has perishable items because they could spoil on the store before being sold or dispatched. Many international accounting standards do not enable LIFO valuation; LIFO is thus not an optimal strategy for organizations extending abroad.

Analyze the issue/outcome.

Changing from LIFO to FIFO usually leads to an increment in stock and earnings for the year or years in question for taxes and financial analysis considerations. Since FIFO generates more net revenue during heightened values, it also generates more income tax expenses using the LIFO approach throughout a time of increasing costs, on the other hand, would lead to reduced net earnings. As a result, this strategy might show a decreased tax bill. When a corporation utilizes LIFO, all overall sales and sales revenue are reported in current amounts on the financial statements. The consequent gross margin is a good predictor of the company’s capacity to earn income than FIFO net income, including significant inventories (paper) gains. In addition, when using the FIFO method, the first unit in stock is assumed to be the only one till it is purchased. Mostly on the income statement, FIFO delivers a much more accurate figure for closing stock.

On the other hand, FIFO raises net earnings, which might lead to a rise in unpaid taxes. The stated changes in inventory in each year increased. On Feb 1, 2008, the mentioned variations in stock improved by 4.1 million dollars opening the earnings balancing act by 4.1 dollars million and rising stock and income statement balance by 8.5 million dollars and 5.4 million dollars as of Jan 31, 2009, by $6.9 and 4.3 million dollars as of Jan 31, 2010, and so by 7.6 million dollars and 4.7 million dollars as of Jan 31, 2011, respectively. The following were reasons for Virco’s stated change of FIFO; The Company feels that the FIFO method for the materials element of Stock is preferred because it unifies the inventory valuation methodologies for all stock constituents into a specific procedure and accurately represents actual financing costs on the books of accounts. Furthermore, recording Stock as FIFO connects financial statements with the Firm’s credit basis within its credit line.

Recommendations.

The FIFO and LIFO evaluation procedures are financial accounting that evaluates the value of stocks. Because inventory is seen FIFO and LIFO favorably, the identical inventories have dissimilar savings depending on the method employed. Due to this, switching from LIFO to FIFO could significantly impact your profit and loss statement. Suppose a corporation converts from FIFO to LIFO. In that case, it must choose to reinterpret financial data from past decades to address the current method or if the new method can only be used for ongoing and prospective years.